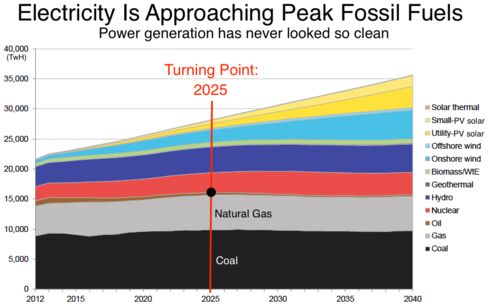

The World Nears Peak Fossil Fuels for Electricity

Tom Randall, Bloomberg

June 2, 2016

Here are eight massive shifts coming soon to power markets.

1. There Will Be No Golden Age of Gas

Since 2008, the single most important force in U.S. power markets has been the abundance of cheap natural gas brought about by fracking. Cheap gas has ravaged the U.S. coal industry and inspired talk of a “bridge fuel” that moves the world from coal to renewable energy. It doesn’t look like that’s going to happen.

The costs of wind and solar power are falling too quickly for gas ever to dominate on a global scale, according to BNEF. The analysts reduced their long-term forecasts for coal and natural gas prices by a third for this year’s report, but even rock-bottom prices won’t be enough to derail a rapid global transition toward renewable energy.

“You can’t fight the future,” said Seb Henbest, the report’s lead author. “The economics are increasingly locked in.” The peak year for coal, gas, and oil: 2025.

2. Renewables Attract $7.8 Trillion

Humanity’s demand for electricity is still rising, and investments in fossil fuels will add up to $2.1 trillion through 2040. But that will be dwarfed by $7.8 trillion invested in renewables, including $3.4 trillion for solar, $3.1 trillion for wind, and $911 billion for hydro power.