With each passing year, more decision makers are realizing that city buses are an ideal application for EVs. They drive predictable routes. They can easily be charged overnight in depots or at scheduled stops during the day. They constantly stop and go, which is ideal for EV drivetrains and regenerative braking. And the prospect of eliminating the noise and the clouds of black soot associated with legacy diesel buses is attractive to both riders and city planners. Best of all, e-buses save money. Lots and lots of money, thanks to lower fuel and maintenance costs. We’re talking about hundreds of thousands of dollars over the lifespan of just one electric bus compared to diesel.

So it’s no wonder that companies in the electric bus market are very optimistic. From North America to Europe to China, the industry continues to mature quickly, and leaders are beginning to emerge, with strong business models.

Charged recently caught up with a couple of those leaders to talk about the current state of the electric bus market, and learn more about developing charging standards around the world.

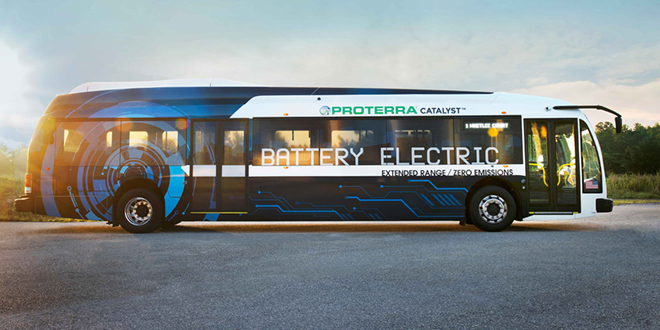

Proterra is a clear leader on our home continent. The company claims over 50% market share in North America in terms of both customers and vehicle count. We asked CEO Ryan Popple where the EV transit industry is headed in the next few years.

Charged: In 2015, you told us that Proterra’s sales pipeline opportunities grew about five to seven times compared to the previous year. Has the fast growth in customer interest continued?

Ryan Popple: Yes, it continues to grow at a pretty impressive clip. Last year we were planning on delivering roughly 1% of new transit vehicles to the US market, and we’ll hit that metric this year.

What’s changed is that now we’re more capacity-constrained than demand-constrained. For 2017, we’re going to triple capacity over 2016. We’ll be shipping between 100 and 150 buses next year, and we already have all of those orders on hand. We used to try to run the business with a six-month order backlog. Now we’re at about 18 months of backlog, and we’re selectively making capital investments in our supply chain so we can bring the backlog back down. If we don’t ramp even faster, the next order we take will be for early 2018 delivery.

I spend a lot of time right now figuring out how to de-risk our growth rate. That means working really closely with a few key suppliers to make sure they can ramp, and also buying ahead on key pieces of inventory. We’ve realized that we won’t be accomplishing our mission if we get customers excited about EVs and then tell them they can’t get vehicles until 2018 or 2019. So the focus has shifted over to supply.

I’ve worked with a lot of tech companies in my career, and usually around the summer is when they inform the board of directors that the growth forecast is going to be a little lower than what was predicted in January. But we’ll be telling our board that we’re going to beat our forecast significantly this year, and our updated forecast will be higher than planned.

Charged: What’s the state of EV awareness among city officials and transit authorities?

Ryan Popple: On the transit demand side, I’d say it’s become an emerging practice to look seriously at EVs when placing an order for new buses. It’s not quite a best practice yet, but an emerging practice is still very powerful. At all of the transit conferences, there are now multiple panels and a lot of experts talking about EVs.

We’ve also seen the first public transit agencies in the country starting to pass board-level resolutions to mandate that their fleets will go to 100% electric in a certain amount of time, which is a very powerful example for other agencies.

From an economics perspective, we’re running the table on natural gas and diesel hybrid. We’ve also found ways for banks to finance the vehicles and deliver great rates of return on investing in EVs to replace diesels.

So, like most industrial markets, it starts with a flat adoption period with only a couple of early adopters, then fast followers, and then full-blown mainstream acceptance. Right now, we’re seeing a tremendous fast-follower stage for electric buses.

Charged: We saw that SEPTA in Philadelphia recently gave Proterra its largest order to date, for 25 electric buses, which sounded great. However, about a week later we saw that they also ordered 525 diesel hybrids from another company, which added some discouraging perspective. When will the EV market reach that level of order sizes?

Popple: Well, we’re already seeing some transit authorities, both smaller and larger than SEPTA, putting together implementation plans on how to replace all buses with EVs. So it will happen.

But at this stage there is really no way to skip the pilot orders and trial periods for electrification – not until the electric adoption rate gets closer to around 20% of the fleets. At that point you’re not going to get fired for buying a lot of EVs when all of your sister agencies already have them, and they work well and save a lot of money. Frankly, I think that is why SEPTA’s first order was 25 instead of 5, because they see it’s already working in other cities. That was the single largest EV order for the North American transit industry. Those aren’t options, that’s a single cash order.

I think that if we had done this pilot order with SEPTA two years ago, even if they started with 5 units at that time, then they wouldn’t be forced to make that large of a commitment to buy diesel hybrids. But no one is going to take the risk on hundreds of EVs until they’ve done a significant pilot. And soon we’ll be announcing the start of pilots with other large northeast agencies, which is great – it needs to happen.

The inevitability of electric buses

The inevitability of electric buses